The strategic yet silent Business Model of Chartink, representing India’s chosen stock trading filter monopoly.

“Where filters become fortune, and signals scale silently.”

Some businesses scream for attention.

Others win in silence.

Chartink is the latter.

While social media influencers debate candlestick patterns, and trading communities flood Telegram with ‘sure shot’ trades, Chartink simply runs — a clean scanner, a loyal user base, and a deceptively simple interface that powers thousands of daily trades.

If the Indian stock market were a city, Chartink would be the underground metro — invisible from above, but carrying the real momentum underneath.

This is the story of a business that:

- Has no mobile app

- Barely advertises

- Hasn’t raised funding

- Yet dominates the retail scanner space

- Powers a cottage industry of signal providers, algo traders, and full-time professionals

In this blog, we’ll decode the business model, psychology, leverage points, moats, and strategic depth behind Chartink — not as a trading tool, but as a product-first business model built for the Indian market.

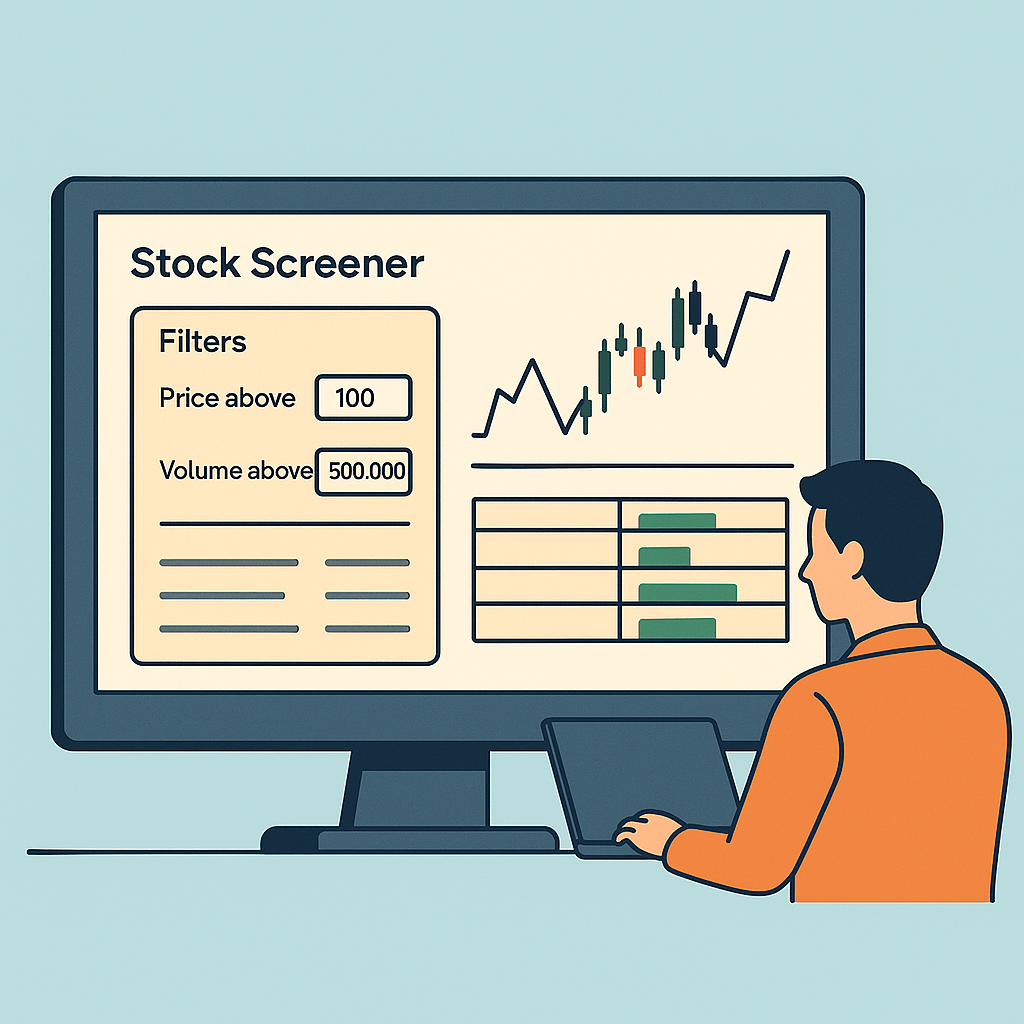

What is Chartink, Really?

At the surface, Chartink is:

- A real-time scanner for NSE stocks and F&O

- A drag-and-drop filter builder with visual logic

- A repository of shared scans (by users)

- A web-based dashboard for alerts, backtests, and watchlists

But under the surface, it’s:

- An API gateway to trading signals

- A platform for community-driven strategy discovery

- A technical layer for retail algo bootstrappers

- A signal-to-execution bridge used by countless creators and prop firms

It doesn’t provide buy/sell recommendations.

It provides leverage — to build your own system, logic, or funnel.

And that’s where the brilliance lies:

It’s a pick-and-shovel play in the options jungle.

Explore our podcast

Chartink’s True Customer Segments

Let’s unpack who really uses Chartink:

1. Retail Traders (Aspiring and Active)

- Use scanners to spot momentum, reversal, breakout stocks

- Some buy the paid alert service

- Most use it daily for watchlists and confirmations

2. Content Creators and Signal Sellers

- Use Chartink scans to provide alerts to followers

- Embed scanner links in paid groups

- Run their own advisory content around scanner logic

3. Educators and Mentors

- Build cohort-based courses

- Teach scanner logic to students

- Share pre-built scans as part of LMS modules

4. Small Algo Traders / Developers

- Use scan conditions to prototype entry logic

- Integrate outputs into trading APIs (via third-party tools)

5. Brokerage Houses / Quant Tools

- Create public scan dashboards to build credibility

- Some partner quietly with Chartink for alerts infrastructure

Revenue Model: Simple Yet Strategic

Chartink’s primary monetization is via:

Monthly Subscriptions:

- ₹780 per month (as of now)

- Features: Real-time scanning, alerts, webhook integrations

Estimated Paid Users (2024):

~50,000 (conservative) to 1,50,000+ (based on traffic + mentions)

Monthly Revenue:

- ₹10 Cr+ (estimated)

Other Revenue Potential:

- API licensing to fintech platforms

- White-label scan engine for brokers

- Affiliate commissions (not actively explored)

- Embedded B2B solutions for education partners

Business Model Canvas – Chartink

| Block | Insight |

|---|---|

| Value Proposition | No-code real-time scanning and alerts for Indian markets |

| Customer Segments | Retail traders, educators, signal providers, prop traders |

| Channels | Organic search, Telegram, Twitter shares, word-of-mouth |

| Customer Relationship | Community-led, high-retention, support via email |

| Revenue Streams | Monthly SaaS subscription (recurring), B2B partnerships |

| Key Resources | Scanning engine, real-time data feed (NSE), infrastructure |

| Key Activities | Data refresh cycles, uptime, rule parsing, alerting system |

| Key Partners | NSE, brokers (informal), quant tool integrators |

| Cost Structure | Data licensing, infra (cloud), team salaries, support ops |

Strategic Depth: The Silent Flywheel

Chartink doesn’t sell content.

It sells infrastructure with leverage.

Every time someone shares a scan link on Twitter or Telegram, it creates 3 effects:

- User onboarding without friction

→ Click. Use. Save. - Community growth

→ Scan authors gain followers. Users follow the author. Everyone credits Chartink. - Content loop

→ Strategy → Scan → Sharing → Trust → More usage → Subscriptions.

This is a classic product-led growth flywheel.

And because users build and share scans, the product improves organically.

Chartink doesn’t have to guess what users want — it watches the scans being made.

Mental Models Behind Chartink’s Success

1. The Platform Mindset

“Don’t be the expert. Be the engine they build their expertise on.”

Chartink isn’t a guru.

It doesn’t claim what to trade.

It lets you decide the logic and simply delivers on it — fast and clean.

2. API Thinking Without Building APIs

Every scanner condition is like an API endpoint:

- Parameterized

- Callable

- Observable

- Sharable

This means creators build businesses on top of Chartink.

3. Asymmetry at Scale

The logic engine runs 24/7.

Each user creates hundreds of scans.

Each scan could lead to 5–10 trades per week.

All of this with minimal human input from Chartink.

4. Founder Leverage

Chartink is a lean team. The infra, code, and data feed do the heavy lifting.

There’s no aggressive marketing team.

No noisy influencers.

Just uptime, utility, and silent scale.

Moats: Why It’s Hard to Replicate Chartink

Despite its simplicity, Chartink has built strong moats:

1. Community Data Layer

Thousands of scans already exist.

New users come in and start with something working. That’s powerful.

2. Link Network Effect

Scan links are embedded in Telegram, WhatsApp, YouTube comments.

Each click is free marketing — and also usage validation.

3. Trust as Currency

Chartink has zero bloat.

Its accuracy is its reputation.

In a world where fake breakouts ruin accounts, reliability becomes a moat.

4. SEBI-Proof Architecture

Chartink doesn’t give tips.

Doesn’t recommend trades.

No SEBI scrutiny = frictionless growth.

5. Integration Depth

Chartink plugs neatly into tools like:

- TradingView (for visualization)

- AlgoTest (for backtesting)

- Telegram Bots (for alerts)

- Webhooks (for execution triggers)

This gives ecosystem leverage without owning the stack.

Growth Levers Still Untapped

Even with its success, Chartink is under-monetized.

Here are scalable ways it can grow further:

1. Scan Store / Marketplace

Allow verified creators to sell premium scans or setups

→ Chartink takes 20–30%

→ Converts creators into marketers

2. Freemium Advanced Features

Custom alerts, sentiment scans, futures-specific patterns, OI change, IV-based conditions

→ Higher price bracket

→ Capture serious traders

3. Broker Integrations (One-Click Execution)

Click scan → Add to basket → Execute via Zerodha, Dhan, etc.

→ Become an execution engine

4. Learning Hub / Courses

Host top traders teaching “How to use Chartink to trade Breakouts”

→ Chartink earns through revenue share

→ Builds retention and activation

5. Mobile App with Push Alerts

This is the most obvious gap.

Chartink is web-only. A well-designed mobile app = better activation and LTV.

Here are high-intent keywords this post is optimized for:

Final Take: Quiet Software. Loud Impact.

The Indian stock market is loud.

But behind every YouTube video claiming “This stock will explode!”

There’s a quiet scanner, filtering setups, triggering alerts, guiding entries.

That scanner is often Chartink.

It doesn’t make noise.

It makes sense.

It doesn’t build hype.

It builds structure.

It doesn’t sell dreams.

It gives you the tools to test your reality.

In a world full of signals, the edge isn’t in knowing what to trade.

It’s in building your own system — and Chartink, almost invisibly, is the silent operating system behind thousands of such systems.

That’s not just good product.

That’s great business.

Learn why SEBI banned Jane Street

Explore our article on small business marketing ideas on a budget

If you’re curious about payment gateways, explore the business model of Pine Labs.

Also, Learn how Deloitte makes money

If you’re a startup founder, submit your startup story for free with us

Did you know? Startups like to use our coworking space in Bangalore

Learn more about our coworking space on our YouTube channel Work Theater Studios where we talk about a variety of topics including personal finance, entrepreneurship, business and life.