In the Global financial market industry, one man made a massive fortune during the 2008 financial crisis: Michael Burry. If you are curious like us, you would love to know how he did it. In this blog, we answer, “How did Michael Burry make his fortune?”

The Michael Burry story

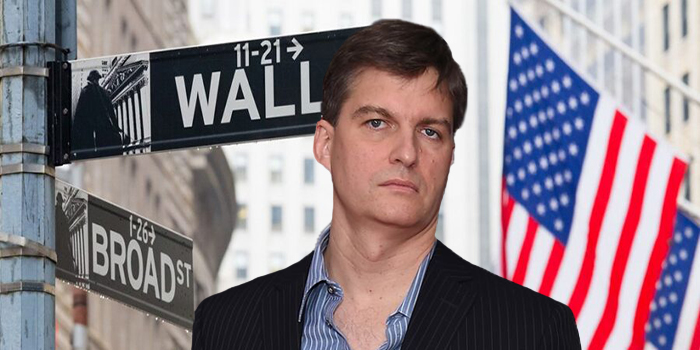

Every once in a while, a figure emerges in the world of business and finance who defies conventional wisdom and takes the market by storm. One such individual is Dr. Michael Burry, the founder of Scion Capital, and the man who successfully predicted and profited from the subprime mortgage crisis of 2008. His unconventional methods, deep understanding of financial markets, and prescient investment strategy have earned him a place among the most respected investors in history.

Dr. Burry’s story is one of relentless determination, critical thinking, and a willingness to stand alone in the face of overwhelming opposition. Born with a glass eye and Asperger’s Syndrome, he overcame these challenges to achieve success in the cutthroat world of finance. His unusual approach to investing and his journey to building a fortune make for a compelling and inspirational narrative.

This blog post aims to take a deep dive into the life and career of Michael Burry, examining the pivotal moments and decisions that have shaped his success. Through an exploration of 27 key steps in his story, we will uncover valuable insights and lessons for aspiring entrepreneurs and investors alike.

For those who are not familiar with his story, Michael Burry is the central figure in Michael Lewis’s best-selling book “The Big Short,” which was later adapted into a popular movie. Through his uncanny ability to see value where others did not, Burry was able to build a fortune that continues to grow to this day.

As you read through the intricate tapestry of Michael Burry’s life and career, you’ll not only learn about the man behind the legend but also gain invaluable knowledge about navigating the complex world of business and investing. This is the Michael Burry Story.

Key Steps in Michael Burry’s Journey to Wealth:

- Early life: Born in 1971 in San Jose, California, Michael Burry had a challenging childhood, dealing with a glass eye due to a childhood cancer and later being diagnosed with Asperger’s Syndrome. Despite these challenges, he excelled academically, showing a natural aptitude for mathematics and critical thinking.

- Education: Burry pursued higher education at the University of California, Los Angeles (UCLA), where he obtained a Bachelor’s degree in economics and a Doctor of Medicine degree. This strong educational foundation would later serve him well in his investing career.

- Investment in the stock market: While still in medical school, Burry began investing in the stock market, teaching himself investment strategies and developing his own unique approach.

- Online forum contributions: Burry contributed to stock market discussion forums, sharing his investment ideas and gaining attention from established investors for his in-depth analysis and accurate predictions.

- Leaving medicine for finance: In a bold move, Burry left his medical residency to pursue a career in finance and investing full-time.

- Early investment successes: Burry’s initial investments, including those in insurance company Conseco and technology company KLA-Tencor, proved successful, validating his decision to leave medicine and demonstrating his investment acumen.

- Attention from industry leaders: Burry’s early investment successes and online presence led to interest from major investors, such as Joel Greenblatt, who offered him a job at Gotham Capital.

- Declining Gotham Capital’s offer: Instead of accepting the job offer from Greenblatt, Burry decided to chart his own path in the world of investing.

- Inheritance: After his father’s passing, Burry received a significant inheritance, which he used as seed money for his own hedge fund.

- Self-employment: Burry began managing his own investments and those of his family members, eventually attracting the attention of other investors who wanted to invest with him.

- Establishing Scion Capital: In 2000, using his inheritance and funds from investors, Michael Burry started his own hedge fund, Scion Capital. This marked a significant step in his career, allowing him to fully apply his unique investment strategy.

- Focusing on undervalued stocks: Burry’s initial investment approach was to focus on undervalued and overlooked small-cap stocks, demonstrating his ability to identify opportunities that others might overlook.

- Achieving impressive returns: Scion Capital quickly gained recognition for its impressive returns, with a reported 55% return in its first year and a cumulative return of 214% between 2000 and 2005.

- Studying the housing market: Burry shifted his focus to the housing market, conducting extensive research and identifying a bubble in the subprime mortgage industry.

- Identifying the risk in mortgage-backed securities: Burry’s research led him to recognize the significant risk posed by mortgage-backed securities, particularly those tied to subprime mortgages.

- Betting against the housing market: In a contrarian move, Burry decided to bet against the housing market by purchasing credit default swaps on subprime mortgage-backed securities.

- Facing skepticism and pressure: As Burry’s bet against the housing market went against the conventional wisdom, he faced skepticism and pressure from investors to change his strategy.

- Standing his ground: Despite the mounting opposition, Burry remained steadfast in his belief that the housing market would collapse, ultimately leading to the subprime mortgage crisis.

- Vindication: In 2007, the subprime mortgage crisis unfolded, validating Burry’s predictions and proving his credit default swaps to be a highly profitable investment.

- Closing Scion Capital: In 2008, after achieving significant success with his bet against the housing market, Burry closed Scion Capital to focus on his own investments.

- The Big Short: Michael Lewis’s book “The Big Short” brought Burry’s story to the mainstream, highlighting his role in predicting and profiting from the subprime mortgage crisis and increasing his public profile.

- Re-entering the investment world: In 2013, Burry founded a new hedge fund, Scion Asset Management, making a return to the world of professional investing.

- Focus on value investing: In his new venture, Burry continued to emphasize value investing, seeking out undervalued companies and investment opportunities.

- Predicting new market trends: Burry has consistently demonstrated an ability to identify potential market trends and opportunities, such as his investments in water resources and his warnings about passive investing.

- Adapting to market changes: Throughout his career, Burry has shown a willingness to adapt his investment strategies to evolving market conditions, ensuring his continued success.

- Remaining a contrarian investor: Despite his success, Burry has maintained his contrarian approach to investing, often seeking out opportunities that the broader market has overlooked or dismissed.

- Long-term success: Through his various investments, Michael Burry has built a net worth of over $300 million, a testament to his investing prowess and long-term success.

Key Insights and Learnings for Entrepreneurs:

- Embrace your individuality: Burry’s unique background and approach to investing were key to his success. Embrace your own individuality and find your niche in the market.

- Trust your instincts and analysis: Even when the market and others around you may disagree, trust your analysis and instincts, provided they are backed by thorough research.

- Be persistent: Success is not always immediate, and sometimes you may face setbacks. Stay persistent and committed to your goals.

- Think outside the box: To achieve exceptional results, you must be willing to challenge conventional wisdom and explore alternative strategies.

- Learn from failure: Use failures and setbacks as an opportunity to learn and grow, rather than a reason to give up.

- Be patient: Building wealth takes time, and it’s essential to remain patient and disciplined in your investment strategy.

The story of Michael Burry is both inspiring and instructive, offering valuable lessons for entrepreneurs and investors alike. By examining his journey to wealth, we can gain a deeper understanding of the qualities that set him apart and learn how to apply these principles to our own lives.

In a world that often rewards conformity and adherence to established norms, Burry’s unique approach to investing is a testament to the power of individuality and critical thinking. By learning from his experiences and implementing the key insights gleaned from his story, we too can chart our own path to success, whether in the world of business, investing, or any other field that demands creativity, perseverance, and the courage to go against the grain.

Ultimately, the Michael Burry story teaches us that the road to wealth and success may not always be smooth, but with determination, hard work, and an unwavering belief in our own abilities, even the most daunting challenges can be overcome. Let the remarkable journey of Dr. Michael Burry inspire and guide you as you strive to achieve your own dreams and aspirations.

Did you know? FinTech Startups like to use our coworking space in Bangalore

Learn more about our coworking space on our YouTube channel Work Theater Studios where we talk about a variety of topics including personal finance, entrepreneurship, business and life.

Did you know? We also have a private theatre in Bangalore.