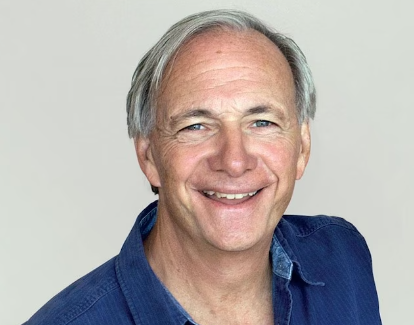

In the global financial market industry, there is a name that stands out as the most insightful hedge fund leader: Ray Dalio. If you are curious like us, you would love to know how he did it. In this blog, we answer, “How did Ray Dalio make his money?”.

The Ray Dalio Story

The world of finance is filled with stories of success, but few are as intriguing and insightful as that of Ray Dalio. As the founder of Bridgewater Associates, one of the world’s largest hedge funds, Dalio has not only accumulated a vast fortune but has also established himself as an influential thought leader in the realms of investing, management, and economic theory. This long-form blog post aims to explore the fascinating journey of how Ray Dalio built his empire, and most importantly, share the valuable lessons that budding entrepreneurs can learn from his experiences.

Ray Dalio’s story is a testament to the power of curiosity, hard work, and constant learning. Born in 1949 in Jackson Heights, Queens, New York, Dalio grew up in a middle-class family. His father was a jazz musician, and his mother was a homemaker. Although not initially interested in the world of finance, a fortuitous encounter with the stock market at the age of 12 sparked his lifelong passion for investing.

From his early days trading stocks to the founding of Bridgewater Associates, Dalio’s relentless pursuit of knowledge and understanding has been a driving force behind his success. His unique approach to investing, combined with a keen interest in understanding the underlying principles of the global economy, has led to the development of his acclaimed “All Weather” investment strategy and a consistent track record of impressive returns.

Dalio’s journey is not just about his remarkable success as an investor, but also as a thought leader and philosopher. His book “Principles: Life and Work” has become an international bestseller, offering readers a glimpse into the life lessons and management principles that have guided his personal and professional life. In sharing these principles, Dalio hopes to help others achieve their own success and fulfillment.

This blog post will take a deep dive into the 27 key steps that shaped Ray Dalio’s path towards wealth and prominence. By understanding these critical milestones, entrepreneurs can glean valuable insights into the mindset, strategies, and tactics that propelled Dalio to the pinnacle of the finance world.

Key Steps in Ray Dalio’s Journey to Wealth

- Discovering the stock market at age 12: Dalio’s interest in investing was ignited when he bought shares of Northeast Airlines for $300, which later tripled in value. This early experience showed him the potential of the stock market and kindled his passion for finance.

- Studying finance at Long Island University: Dalio pursued a degree in finance, which provided him with a solid foundation in the field and further fueled his enthusiasm for investing.

- Pursuing an MBA at Harvard Business School: Dalio’s education at Harvard exposed him to a diverse range of ideas and strategies, honing his skills as an investor and deepening his understanding of financial markets.

- Working at the New York Stock Exchange: This hands-on experience gave Dalio valuable insights into the inner workings of financial markets and helped shape his investment approach.

- Joining the commodities division of Merrill Lynch: At Merrill Lynch, Dalio gained experience in commodity trading, further broadening his knowledge base and refining his investment strategy.

- Becoming a futures trader at Dominick & Dominick: This role provided Dalio with a deep understanding of futures markets and the mechanics of trading, which would later prove invaluable in his career.

- Founding Bridgewater Associates in 1975: Starting with just a small office in his Manhattan apartment, Dalio set out to build a different kind of investment firm, one focused on transparency, innovation, and long-term results.

- Developing an investment philosophy based on understanding economic cycles: Dalio’s unique macroeconomic perspective enabled him to predict market trends and capitalize on opportunities that other investors missed.

- Establishing the firm’s culture of radical transparency: This culture encourages open dialogue, constructive criticism, and collective decision-making, which have become hallmarks of Bridgewater Associates.

- Expanding Bridgewater’s client base: Dalio’s reputation for sound investment advice and solid returns attracted a growing number of institutional clients, including pension funds, endowments, and sovereign wealth funds.

- Developing risk parity investment strategy: This strategy, which equalizes risk across asset classes, has become a cornerstone of Bridgewater’s approach and has been widely adopted by other investment firms.

- Launching the Pure Alpha Fund in 1989: This hedge fund aimed to generate consistent returns regardless of market conditions and has since become one of the most successful in the industry.

- Surviving the 1991 recession: Dalio’s prudent risk management and understanding of economic cycles allowed Bridgewater to weather the storm and emerge stronger.

- Implementing the “All Weather” investment strategy: Introduced in 1996, this strategy aimed to protect portfolios from market volatility by diversifying across asset classes and balancing risk.

- Navigating the dot-com bubble: Dalio’s macroeconomic perspective helped Bridgewater avoid the pitfalls of the tech bubble, further cementing its reputation as a prudent and forward-thinking investment firm.

- Becoming the world’s largest hedge fund in 2005: Bridgewater’s assets under management exceeded $100 billion, reflecting the firm’s success and growing influence in the financial world.

- Predicting the 2008 financial crisis: Dalio’s understanding of economic cycles enabled him to foresee the looming crisis, helping his clients minimize losses and maintain their trust in Bridgewater.

- Emerging stronger after the crisis: While many financial institutions struggled, Bridgewater continued to thrive, further solidifying its status as a leader in the industry.

- Receiving numerous industry awards: Bridgewater’s success has been recognized with numerous awards, including being named the “Hedge Fund of the Year” by Institutional Investor multiple times.

- Publishing the “Economic Principles” report in 2011: This report outlined Dalio’s macroeconomic framework and provided insights into his investment philosophy.

- Transitioning to a co-CIO model: In 2011, Dalio began sharing the chief investment officer role, ensuring a smooth succession plan for Bridgewater’s future.

- Launching the Optimal Portfolio Fund: This new fund offered a lower-fee alternative to traditional hedge funds, providing investors with greater accessibility to Bridgewater’s strategies.

- Releasing the “Principles” mobile app: This app shared Dalio’s management principles with a broader audience, promoting self-reflection and continuous learning.

- Writing “Principles: Life and Work”: Published in 2017, this bestselling book offered readers insights into Dalio’s personal and professional philosophies.

- Stepping down as co-CIO in 2020: Dalio’s decision to step back from daily investment activities marked a new chapter in his career, focusing on mentoring, writing, and philanthropy.

- Launching the “Changing World Order” series: This ongoing series of articles and podcasts explores the shifting global landscape and its implications for the future.

- Philanthropy and social impact: Through the Dalio Foundation, Dalio has donated millions to various causes, including education, environmental protection, and global health.

Key Insights and Learnings for Entrepreneurs

- Embrace a growth mindset: Dalio’s success is rooted in his commitment to continuous learning and adaptation. Entrepreneurs should embrace this mindset to remain agile and competitive in a rapidly changing world.

- Understand the importance of culture: Bridgewater’s radical transparency culture has been crucial to its success. Entrepreneurs should prioritize establishing a strong and well-defined company culture that encourages open communication, collaboration, and continuous improvement.

- Develop a strong foundation in your field: Dalio’s deep understanding of finance and economics was essential to his success. Entrepreneurs should invest time and effort in mastering the fundamentals of their industry.

- Be disciplined in your decision-making: Dalio’s approach to investing is rooted in a disciplined, data-driven methodology. Entrepreneurs should apply a similar level of rigor to their decision-making processes, avoiding emotional biases and focusing on objective evidence.

- Seek out diverse perspectives: Dalio’s willingness to learn from others and incorporate diverse viewpoints into his decision-making process has been invaluable. Entrepreneurs should actively seek out alternative perspectives and be open to challenging their own assumptions.

- Understand the importance of risk management: Dalio’s ability to navigate economic downturns and market volatility was crucial to his long-term success. Entrepreneurs should prioritize risk management and develop strategies to weather unforeseen challenges.

- Focus on long-term goals: Dalio’s investment philosophy emphasizes long-term thinking and patience. Entrepreneurs should adopt a similar mindset, focusing on sustainable growth and long-term value creation rather than chasing short-term gains.

Ray Dalio’s remarkable journey from a curious young investor to the founder of the world’s largest hedge fund is filled with valuable lessons for entrepreneurs and aspiring leaders. By understanding the key steps in his story, we can glean insights into the mindset, strategies, and tactics that propelled him to the pinnacle of the finance world.

The Ray Dalio story demonstrates that success is not a product of luck or natural talent, but rather the result of hard work, continuous learning, and a relentless pursuit of excellence. By embracing these principles and applying them to their own endeavors, entrepreneurs can unlock their full potential and chart their own path to success.

In an ever-evolving global landscape, Ray Dalio’s journey offers a blueprint for overcoming challenges, adapting to change, and achieving long-lasting success. As we continue to navigate the complexities of the modern world, the lessons from Dalio’s story can serve as a guiding light for the next generation of entrepreneurs and leaders.

Did you know? FinTechs like to use our coworking space in Bangalore

Learn more about our coworking space on our YouTube channel Work Theater Studios where we talk about a variety of topics including personal finance, entrepreneurship, business and life.

Did you know? We also have a private theatre in Bangalore.