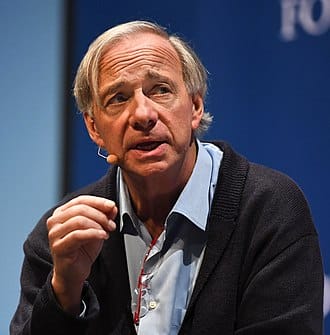

Today we cover Ray Dalio on the Entrepreneur Stories by Work Theater. His journey is sure to keep you on the edge with room to learn so much.

Ray Dalio is an American billionaire, philanthropist, and the founder of Bridgewater Associates, one of the world’s largest hedge funds. He is renowned for his unique philosophy of life and work, which he has distilled into a set of principles that he has made available for free on his company’s website. Dalio’s principles have been widely embraced by entrepreneurs, investors, and leaders across the world, making him one of the most influential business thinkers of our time.

Early Days, the Struggle and rise to prominence:

Ray Dalio was born on August 8, 1949, in Queens, New York, and grew up in a middle-class family. His father was a jazz musician, and his mother was a homemaker. He attended Long Island University and later transferred to Harvard College, where he earned a degree in economics. From an early age, Ray showed an interest in investing and started trading stocks in high school. He went on to attend Long Island University, where he earned a degree in finance.

After graduation, Ray landed a job on the floor of the New York Stock Exchange, where he learned the ins and outs of the trading industry. He then moved on to work for a few brokerage firms before starting his own business in his apartment with just $3,000 in savings. He named his company Bridgewater Associates, and his goal was to create a firm that would use data-driven investment strategies to minimize risk and maximize returns.

In the early days, Ray faced many challenges and setbacks. His business struggled to attract clients, and he had to take out loans to keep it afloat. However, he persisted and continued to refine his investment strategies. He eventually landed his first big client, the World Bank, which helped to establish his reputation as a trusted investor.

Over time, Bridgewater Associates became one of the most successful hedge funds in history, with over $140 billion in assets under management. Ray’s unique investment strategies, which focused on diversification, risk management, and data-driven decision-making, attracted a large following of clients, including institutional investors, pension funds, and wealthy individuals.

Ray’s success as a hedge fund manager and his unique philosophy on life and business have made him one of the most influential business leaders of our time. His “Principles” document has become a must-read for entrepreneurs and business leaders looking to learn from his experiences and apply his principles to their own lives and businesses.

Ray Dalio’s rise to prominence began in the 1980s, when he developed a unique investment strategy that focused on macroeconomic trends and diversification across asset classes. He also pioneered the use of computer models and algorithms to make investment decisions, which set Bridgewater Associates apart from other hedge funds.

Dalio’s success as an investor and entrepreneur attracted attention from media outlets, and he became a sought-after speaker on the conference circuit. In 2011, he gave a TED Talk entitled “How to build a company where the best ideas win,” which has been viewed over 10 million times.

27 Key Learnings from Ray Dalio’s Philosophy through quotes:

- Radical transparency: “The greatest tragedy of mankind comes from the inability of people to have thoughtful disagreements to find out what’s true and what’s best.”

- Embrace reality: “The more you can see things as they are, rather than as you wish or hope they would be, the more effectively you can operate.”

- Humility: “If you’re not humble, life will visit humbleness upon you.”

- Failure is a learning opportunity: “Pain plus reflection equals progress.”

- Be radically open-minded: “Don’t let your ego get in the way of your willingness to learn.”

- Continuous improvement: “Constantly seek improvement, never settle for mediocrity.”

- Systematic decision-making: “Think through your principles for dealing with reality, write them down, and then test the hell out of them.”

- Diversification: “Don’t put all your eggs in one basket.”

- Risk management: “The biggest mistake investors make is to believe that what happened in the recent past is likely to persist.”

- Radical truth and radical transparency: “All great relationships, the ones that last, require effort and investment of time, and the most important investment of all is the investment in truth.”

- Embrace change: “Change is inevitable and the best way to approach it is to embrace it.”

- Principles over personalities: “I think it’s important to choose your principles over your personality.”

- Failure is an opportunity: “Failure is a problem only if you let it become a defeat.”

- Open-mindedness: “The best way to approach life is with an open mind and a willingness to learn.”

- Accountability: “Accountability is essential to any successful endeavor.”

- Rational decision-making: “Making decisions based on reason and evidence is essential to success.”

- Holistic thinking: “To truly understand something, you must look at it from every angle.”

- Anticipate and adapt: “Anticipate and adapt to change in order to stay ahead of the game.”

- Purpose and meaning: “A life without purpose and meaning is empty and unfulfilling.”

- Continual learning: “Never stop learning, and always seek out new challenges.”

- Radical candor: “Radical candor is essential to building strong relationships and achieving success.”

- Embrace diversity: “Diversity of thought and experience is essential to making good decisions.”

- Focus on the big picture: “Don’t get bogged down in the details and lose sight of the big picture.”

- Work-life balance: “It’s important to strike a balance between work and life in order to achieve happiness and fulfillment.”

- Embrace discomfort: “Embrace discomfort and challenge yourself to grow.”

- Communication: “Clear communication is essential to success in any endeavor.”

- Seek out feedback: “Seek out feedback and use it to improve yourself and your work.”

Ray Dalio is an inspiration to many, having built one of the most successful hedge funds in history and creating a unique philosophy that has helped many entrepreneurs and business leaders achieve their own success. His journey from a middle-class family to a business magnate is a testament to the power of hard work, dedication, and perseverance. He has shown that anyone can achieve success with the right mindset and principles, even in the face of adversity.

One of the most significant takeaways from Ray Dalio’s philosophy is the importance of embracing failure and learning from it. His “principles” document highlights the many failures he experienced throughout his career and how he used them as learning opportunities. This approach to failure is refreshing in a society that often demonizes it, instead of recognizing it as an essential component of growth and development. Ray Dalio has shown that with the right mindset, we can turn our failures into our greatest successes.

In conclusion, Ray Dalio’s journey and philosophy serve as an inspiration to us all. By embracing his principles, we can achieve success in our personal and professional lives, and become better versions of ourselves. His willingness to share his experiences and knowledge has been a valuable contribution to the world of business and entrepreneurship. As we continue to face new challenges and uncertainties, we can look to Ray Dalio’s philosophy for guidance and inspiration to help us navigate through life’s complexities.

Finance Startups like to work from Work Theater, our office space in Bangalore.

Learn more about our coworking space on Think Remote.