Franklin Ochoa’s “Secrets of a Pivot Boss” is not just about pivots and Central Pivot Range (CPR); it is a holistic approach to understanding market behavior, building a solid foundation for making informed trading decisions.

In the vast and often mysterious realm of financial markets, Franklin Ochoa’s “Secrets of a Pivot Boss” stands out as a beacon of clarity, guiding both novice and experienced traders alike towards successful trading strategies. This is not a book that merely scratches the surface of stock trading; it delves deep into the psychological and technical aspects, taking readers on a comprehensive journey through the complex world of financial markets. It is more than a mere compilation of trading strategies; it’s a masterclass in understanding the mechanics of the market, the psychology of traders, and the application of pivot points – a central theme throughout the book.

“Secrets of a Pivot Boss” is not just about pivots and Central Pivot Range (CPR); it is a holistic approach to understanding market behavior, building a solid foundation for making informed trading decisions. Its core tenet is that a comprehensive understanding of pivot points can provide valuable insights into price movement and market trends. This understanding, coupled with a strong foundation in market psychology and trading strategies, can give traders a significant edge in the cut-throat world of financial markets.

Ochoa, a veteran trader with a wealth of experience in the financial markets, has distilled his years of trading wisdom into this book, sharing the hard-earned lessons that have shaped his successful career. The book is designed to offer a comprehensive learning experience for readers, with practical examples and real-world applications of the principles discussed. It is a guide that can help traders navigate the turbulent waters of the stock markets with confidence and poise.

The book’s objective is to demystify the concept of pivots, elucidating how they can be used effectively to predict market behavior and craft profitable trading strategies. Ochoa’s “Secrets of a Pivot Boss” is a testament to his deep understanding of the markets and his ability to convey complex ideas in an accessible, engaging manner. His insights into the pivotal points of trading – pun intended – are worth their weight in gold.

As we delve into this enlightening book, we uncover a trove of valuable knowledge that can equip traders with the necessary tools to thrive in the unpredictable world of financial markets. Today, we will explore 18 key ideas from “Secrets of a Pivot Boss,” providing you with a detailed understanding of each concept, supported by relevant examples.

Key Ideas and Relevant Examples

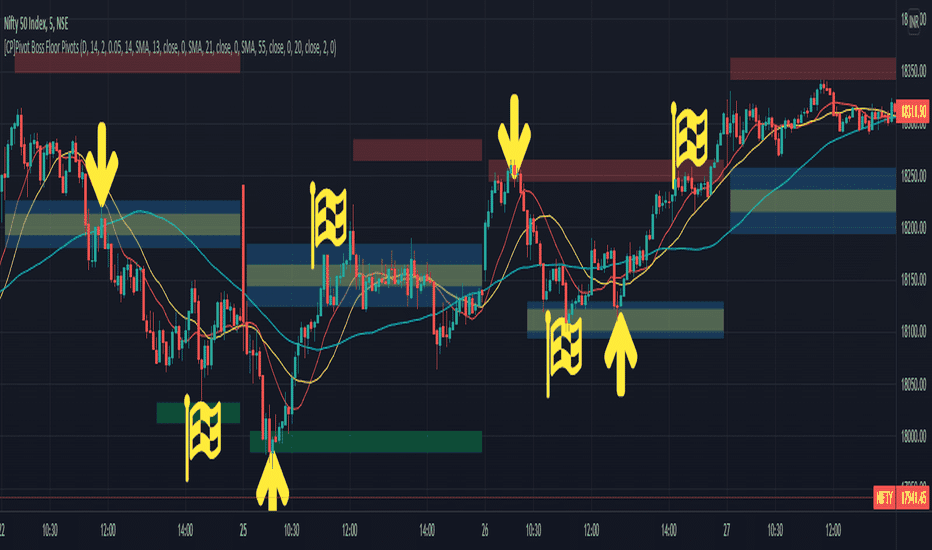

- Understanding Pivot Points: Pivot points, according to Ochoa, are technical analysis indicators used to determine the overall trend of the market over different time frames. They are calculated using the high, low, and closing prices from the previous trading session. The pivot points serve as a foundation for the book’s strategies, offering insights into potential support and resistance levels.

- The Power of the Central Pivot Range (CPR): The CPR is a robust tool used to gauge market sentiment. It is the range where the pivot point, the high, and the low from the previous day converge. A market above the CPR indicates bullish sentiment, while a market below it indicates bearish sentiment. Ochoa emphasizes the significance of the CPR in determining market bias.

- The Psychology of Trading: Ochoa asserts that psychological factors significantly influence trading decisions. Fear and greed, for example, can lead to hasty decisions that may not align with a trader’s strategies. Understanding this can help traders control their emotions and make more rational decisions.

- Market Structure and Price Action: Recognizing patterns in market structure and price action can provide valuable insights into future price movements. Ochoa teaches readers to identify these patterns and utilize them effectively in their trading strategies.

- Volume Profile Analysis: Volume profile analysis helps traders understand at what prices securities are being traded most, providing insights into market sentiment. Ochoa emphasizes the importance of this analysis in identifying key pivot points and trading opportunities.

- Mastering the Market Auction Theory: This theory suggests that markets are driven by continuous two-way auctions. Understanding the mechanics of these auctions can provide traders with valuable insights into market behavior, allowing them to anticipate potential price movements.

- Utilizing Opening Range Principles: The opening range is the range of prices traded during the first part of the trading session. Ochoa demonstrates how traders can use these principles to predict the day’s trading patterns and make strategic decisions.

- The Power of Value Area: The value area, determined by market profile analysis, is the price range where approximately 70% of the previous day’s volume occurred. Trading within the value area can offer traders a high probability of success, according to Ochoa.

- Incorporating Multi-Pivot Lines: Multi-pivot lines are significant resistance or support levels on a price chart where the asset price has changed direction multiple times. Ochoa underscores their significance in identifying potential breakout points.

- Balancing Risk and Reward: One of the most crucial aspects of successful trading is understanding the balance between risk and reward. Ochoa provides practical strategies to manage risks while maximizing potential returns.

- Adopting a Disciplined Approach: Ochoa asserts that discipline is a key component of successful trading. Traders must stick to their strategies and avoid making impulsive decisions based on transient market movements.

- Importance of Market Trends: Recognizing and understanding market trends is vital for crafting effective trading strategies. Ochoa provides a comprehensive guide on how to identify and leverage market trends.

- Building a Trading Plan: Ochoa emphasizes the importance of having a detailed trading plan. This plan should outline the trader’s goals, risk tolerance, and strategies, providing a roadmap for trading decisions.

- Adapting to Market Changes: The financial market is highly dynamic, with market conditions changing rapidly. Ochoa advises traders to be flexible and adapt their strategies to align with current market conditions.

- Leveraging Pivot Scenarios: Ochoa introduces several pivot scenarios that traders can use to predict potential market movements. These scenarios are based on the relationship between the market price and the pivot point.

- The Art of Reading Market Sentiment: Ochoa highlights the importance of understanding market sentiment in predicting price movements. He provides practical tips on how to analyze market sentiment and incorporate it into trading strategies.

- The Role of Institutional Investors: The actions of institutional investors can significantly influence market trends. Ochoa provides insights into how traders can anticipate these actions and use them to their advantage.

- Continuous Learning and Improvement: Lastly, Ochoa emphasizes that trading is a continuous learning process. Traders must constantly strive to improve their skills and knowledge to stay ahead in the dynamic world of financial markets.

As we conclude our exploration of “Secrets of a Pivot Boss,” it becomes evident that this book is not just about understanding pivots and trading strategies; it is about embracing a holistic approach to trading. It emphasizes the importance of understanding market behavior, psychology, and continuously adapting to the ever-changing dynamics of the financial markets.

Franklin Ochoa, with his profound experience and expertise, has crafted a masterpiece that provides a comprehensive guide to navigating the complex world of financial markets. His book instills in traders the confidence to make informed trading decisions, armed with the knowledge of pivots, market psychology, and effective trading strategies.

In a nutshell, “Secrets of a Pivot Boss” offers a wealth of knowledge that can transform your trading journey. It encourages readers to evolve from being passive participants in the financial markets to becoming astute, informed, and proactive traders. It is a quintessential guide that caters not only to the number-crunching aspect of trading but also to the human element, acknowledging the role of psychology in trading decisions. From a novice starting their journey in the stock markets to an experienced trader looking to refine their strategies, this book can provide invaluable insights to all.

As you close the last page of “Secrets of a Pivot Boss,” you’re not merely finishing a book; you are taking a significant step towards a more informed, disciplined, and strategic approach to trading. Whether you’re assessing the CPR, identifying pivotal points, or analyzing market sentiment, you’ll find yourself applying the teachings of this book instinctively. So, arm yourself with the wisdom Franklin Ochoa has to offer and step into the world of trading with renewed confidence and proficiency.

Let your trading journey be guided by knowledge, strategy, and the secrets of a true pivot boss. Happy Trading!

Did you know? Traders like to use our co-working space in Bangalore

Learn more about our coworking space on our YouTube channel Work Theater Studios where we talk about a variety of topics including personal finance, entrepreneurship, business and life.

Did you know? We also have a private theatre in Bangalore.