Dive into the core of financial markets with 18 important microeconomic factors that can transform your investment strategy.

In the ever-evolving world of finance, stock traders and investors continuously seek the holy grail of information – that singular factor, which when harnessed, promises unimaginable returns. However, the reality is far more complex. No single variable rules the market. Instead, it’s a myriad of interconnected microeconomic factors that, when combined, paint the complete picture. These factors, often overlooked by those hoping for a quick gain, hold the key to understanding market nuances, predicting trends, and ultimately, achieving consistent returns.

Also explore: A Case Study of the SEBI ban on Jane Street

Successful investors understand that mastering the market is akin to mastering a finely tuned instrument. Every string, every key plays a role, and knowing which ones to strike at the right moment can make a symphony. Microeconomics, which delves deep into the decisions of individuals and firms, offers insights into these ‘keys’. By focusing on this granular level of the economy, traders can gain a competitive edge, predicting market shifts before they become obvious to the larger populace.

Also explore our article on Macroeconomic Factors Affecting Stock Markets

But why does microeconomics matter so much in the grand theater of financial markets? The answer lies in the intricate web of supply and demand, consumer behavior, and firm decisions that drive stock prices, bond yields, and currency values. As the saying goes, “the devil is in the details”. By immersing ourselves in these details, we become more attuned to market rhythms, allowing us to dance with volatility rather than against it.

However, the sheer magnitude of factors can be daunting. For many, this realm of economics becomes a confusing maze, filled with jargon and complex relations. But fret not. This guide aims to decode these very complexities, shedding light on the 18 most crucial microeconomic factors that sway markets. By the end, you’ll not only have a deeper understanding but also a toolkit that can transform your trading strategy.

So, whether you’re a seasoned trader looking to sharpen your insights or a novice hoping to get a foothold in the bustling financial marketplace, journey with me. Let’s unravel the microeconomic tapestry that holds the keys to market mastery.

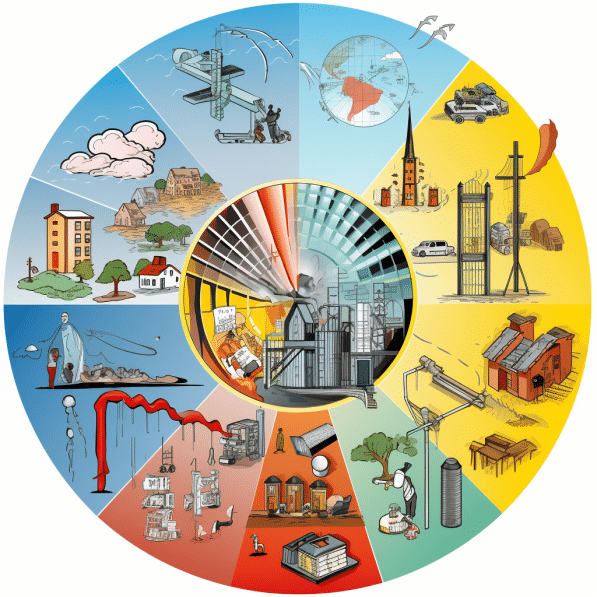

18 Microeconomic Factors Influencing Markets:

- Consumer Preferences and Behavior: At the heart of microeconomics is the individual – the consumer. Their preferences, driven by tastes, income, and external influences, dictate demand for goods and services. Understanding shifting consumer behavior can anticipate market reactions.

- Supply and Demand: The equilibrium of supply and demand determines prices. An imbalance can cause price fluctuations, impacting stock values, especially in industries sensitive to price changes.

- Elasticity: It defines how responsive quantity demanded or supplied is to price changes. Products with high elasticity see significant demand shifts with minor price changes.

- Cost of Production: For companies, the cost of producing goods directly affects profitability. Rising costs can squeeze margins, affecting stock prices.

- Competition and Market Structures: From monopolies to perfect competition, market structures shape how firms price their products and can hint at potential market power or vulnerability.

- Technological Advancements: Technological shifts can disrupt industries. Companies that adapt thrive, while those that don’t can see their market value plummet.

- Substitute and Complementary Goods: The presence of alternatives or complements in the market can impact the demand for a product. Recognizing these relations can anticipate market swings.

- Income Levels and Distribution: As people’s incomes rise or fall, so does their purchasing power. Understanding income trends can hint at future demand patterns.

- Government Policies and Regulation: From taxes to subsidies, government interventions can significantly sway market dynamics.

- Factor Markets: These are markets for inputs used in production like labor and capital. Changes in these markets can impact production costs and outputs.

- Externalities: Costs or benefits not accounted for in prices, like pollution. Recognizing externalities can anticipate regulatory interventions or public backlash.

- Consumer Expectations: If consumers expect prices to rise, they might buy now, influencing current demand. Conversely, if they expect a downturn, they might hold off.

- Information Asymmetry: Situations where one party has more or better information than another can lead to market inefficiencies, creating opportunities for informed investors.

- Market Failures: These occur when markets don’t allocate resources efficiently, potentially opening doors for regulatory interventions.

- Dynamics of Scale: Firms can benefit from economies of scale (reduced costs with increased production) or suffer from diseconomies of scale. This dynamic can influence long-term profitability.

- Capital and Investment: The availability and cost of capital can affect a firm’s ability to grow and invest, impacting its market valuation.

- Labor Market Conditions: Employment levels, wages, and worker productivity play a crucial role in determining company profitability and overall market sentiment.

- Opportunity Costs: Every decision has an associated opportunity cost – the benefit foregone from not choosing the next best alternative. Recognizing these costs can offer insights into market shifts.

Conclusion:

As we’ve journeyed through these 18 microeconomic factors, it’s evident that the financial markets are a tapestry of countless intertwined threads. To some, they may seem chaotic, but with the right lens, patterns emerge. Recognizing and understanding these patterns is what differentiates a successful trader from the rest.

Knowledge is power. By delving deep into the microeconomic landscape, we equip ourselves with a potent toolset, enabling us to anticipate market shifts, make informed decisions, and ultimately achieve our financial goals. But remember, markets evolve, and so should our understanding. Continuous learning is the cornerstone of success in this dynamic realm.

While this guide provides a foundational understanding, it’s essential to dive deeper, analyze real-world scenarios, and learn from both successes and failures. The world of trading and investment is as much about instincts and experience as it is about knowledge.

In conclusion, microeconomics isn’t just an academic subject. It’s a compass, guiding traders and investors through the tumultuous seas of financial markets. Embrace it, understand it, and let it lead you to newfound horizons.

Follow Startup Theater on Instagram for valuable content on entrepreneurship

If you’re a startup founder, submit your startup story for free with us

Did you know? Startups like to use our coworking space in Bangalore

Call us to reserve your space at Work Theater

Learn more about our coworking space on our YouTube channel Work Theater Studios where we talk about a variety of topics including personal finance, entrepreneurship, business and life.